Breakout and volume

Submit by MJ 21/02/2017

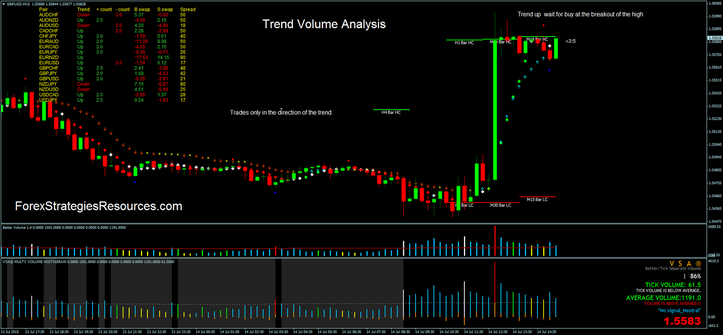

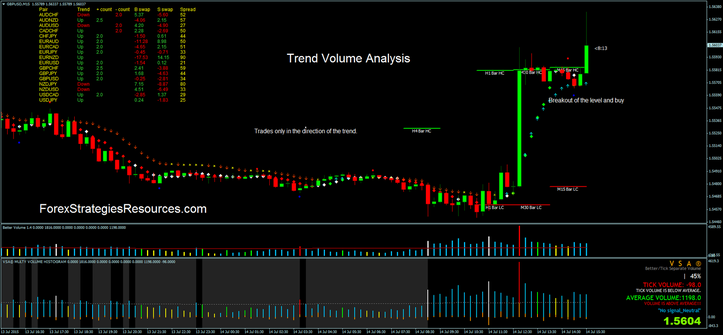

Trend Volume Analysis is a trading system trend following that uses volumes and levels of support and resistance.

The main tool is the dashboard that defines the trend of the currency pairs.

Trades only in the direction of the trend.

If you have a best tool for defines the tendency is good.

Time Frame 15 min or higher.

For intraday trading the session are Newyork and london. (TF 15, 30 min)

Financial Markets: Forex, Indicies, Commodities.

Metatrader Indicators that you see in this template:

Trend Dashboard,

SHI Channel,

VSA trend,

Trend arrows,

Better Volume,

VSA multivolume analysis

Rules for trading with Trend Volume Analysis trading

Trades in the direction of the trend and place a pendig order above below the main level of the support and resistance. If the volumes are less delete order.

First step find a currency pair with a clear trend at 4H TF.

Second step Go at the 15 min TF or 30min TF and wait that the price broken a level of the support or resistance in the direction of the main trend.

In the pictures Trend Volume Analysis trading in action.

ОтветитьУдалитьLet me explain the basic principle how most Forex systems work. They are tuned up to work in a specific market condition. They often make money in a trending market, but loose money in a choppy market. It is not a problem as long as the market is trending and the system is making more money than it loses. Such a system can be profitable for several months and you would be happy with it. BUT...

PREPARE FOR THE WORST...

Market change over time. A well designed system starts with trend analysis to stay away from potentially losing trades. There are two problems of how a Forex system recognizes the trend.

PROBLEM: FALSE "STRONG TREND" INDICATION.

The system responds only to immediate price action. An explosive price movement that is usually the result of news release is tempting people to jump in and make a profit. It looks like a "strong trend", but what usually happens next is a hard fall.

To avoid falling into this trap, check for the SOLUTION to find a REAL trend:

==> http://www.forextrendy.com?nsjjd92834

SECOND PROBLEM: TREND RELIABILITY

Most systems use various indicators to determine the trend. Actually, there is nothing bad about using indicators. One Simply Moving Average can do the job. The problem comes with the question: "Is the market trending NOW?" Whether the market is trending or not trending is not like black and white. The correct question is: "How well the market is trending?"

And here we have something called TREND RELIABILITY.

Trends exist and they can be traded up and down for a profit. You have to focus only on the most reliable market trends. "Forex Trendy" is a software solution to find the BEST trending currency pairs, time frames and compute the trend reliability for each Forex chart:

==> http://www.forextrendy.com?nsjjd92834