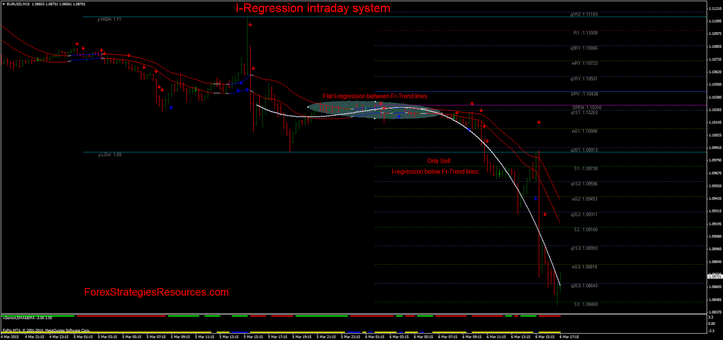

I-Regression intrady trading

Submit by Rivelli 17/02/2017

I-regression intraday trading is trend following and price action strategy. Based on the I-regression indicator.

Time Frame 15 min or 30 min.

Currency pairs: EUR/USD, GBP/USD, AUD/USD, AUD/JPY, GBP/JPY, NZD/USD, USD/CAD, USD/CHF, EUR/JPY. Indicies: S&P 500, Dow Jones, DAX, FTSE.

Metatrader Indicators:

SDZ Pivots,

I-Regression (settig: degree 3, Fstd 0, bars, 100),

FR-Trendlines (filter for price action)

Delta Trend (is an arrow for example, you can use anther arrow),,

I-Gentor- LSMA-EMA (default, filter trend).

I-Regression intraday system trading rules

If the I-regression is above the FR-Trend lines you are looking for buys , if below you are looking for sells and if between Fr-Trendlines the price action is flat.

Buy

I-regression above Fr-Trend lines.

I-Gentor green and blue color( optional),

Delta trend buy arrow.

Do you enter the trade at the close of the bar when you get the signal arrow.

Sell

I-regression below Fr-Trend lines.

I-Gentor red and yellow color (optional),

Delta trend buy arrow.

Do you enter the trade at the close of the bar when you get the signal arrow.

Exit position at the opposite arrow or make profit at the pivot points levels.

Initial stop loss at the previous swing.

This trading system is also good for trading with binary options high/low.

Expiry time 4-6 candles.

In the pictures I-Regression intraday system in action.

Комментариев нет:

Отправить комментарий