Submit by Forexstrategiesresources

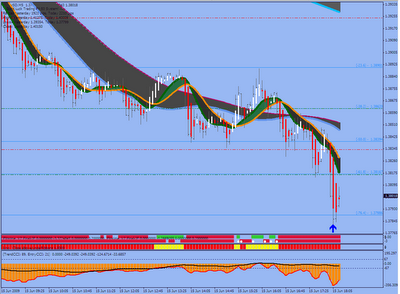

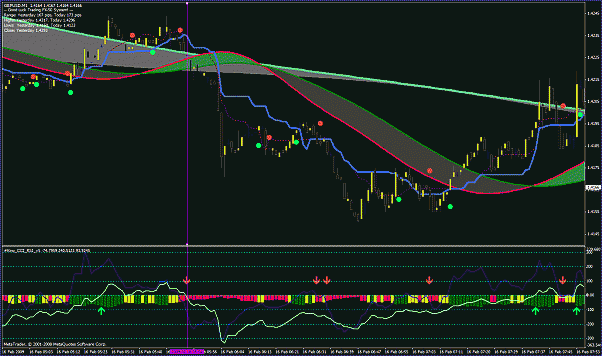

Time Frame 1 min.

Pair: EUR/USD.

Spread Max 0.0015

Indicators:

Keltner Channels with a 22 period moving average

445 Period Exponential Moving Average

Trading Rules

By design this system is a scalping system but I also use it to capture much larger profits. The entry rules for both methods are identical. The difference lies in the exit method. For the scalping method I enter my target exit order immediately after I enter my protective stop. For the larger trend trades I use a combination of the Keltner Channel and the 89 period moving average to help stay in the trades for longer periods. That being said lets go over the entry and exit rules for the scalping system first.

Long Trades

Conditions required for trade entry - in sequence:

1. Price is above or testing the 89 period moving average on the one minute chart.

2. Price is within the Keltner Channels or closely above or below it. * Important - If price is below the Keltner Channels wait for the next trade unless there is a very clear positive divergence between price and the MACD (5/34/5) or it is testing either one of the 89 or 445 period moving averages. If price bar body is overlapping the upper Keltner Channels it is probably still a safe play but stick to your stop rules. It is always best to wait for it to come back and test inside the Keltner Channels.

3. The MACD (5/34/5) Histogram is below zero

4. The Stochastic Momentum is approaching or below –40. For the highest probability trades wait for it to go below –40, however it will not always make it that far especially in strong trends.

5. The 1-period moving average of the MACD turns back up in the direction of the trend and crosses the 5-period moving average of MACD.

At this point you would go Long on the open of the next bar provided price is still within or very closely above or below the Keltner Channel and enter a maximum stop in one of 3 places.

1. One pip outside the lower Keltner Channel

2. 1 pip below the 89 or 445 period moving average if they are directly below the Keltner Channel

12-pips below the trade entry point. Never set your stop further than 12 pips away using this system and try to keep it tighter using the first two choices when possible. This will help you cut your losses short and stay in the game for a long time to come.

For this Keltner channels scalping system your profit goals should be modest with and emphasis on making several quick and small trades. I usually set my scalp trade exit orders immediately after I enter my protective stop in order to eliminate most of the emotional tendencies that naturally occur when trading. I set my exit price between 6 and 12-pips above my entry price.

Short Trades

Conditions required for trade entry - in sequence:

1. Price is below or testing the 89 period moving average on the one minute chart.

2. Price is within the Keltner Channels or closely above or below it. * Important - If price is above the Keltner Channels wait for the next trade unless there is a very clear negative divergence between price and the MACD (5/34/5) or it is testing either one of the 89 or 445 period moving averages. If price bar body is overlapping the lower Keltner Channel it is probably still a safe play but stick to your stop rules. It is always best to wait for it to come back and test inside the Keltner Channel.

3. The MACD (5/34/5) Histogram is above zero.

4. The Stochastic Momentum is approaching or above +40. For the highest probability trades wait for it to go above +40, however it will not always make it that far especially in strong trends.

5. The 1-period moving average of the MACD turns back down in the direction of the trend and crosses the 5 period moving average of MACD.

At this point you would sell-short on the open of the next bar provided price is still within or very closely above or below the Keltner Channel and enter a maximum stop in one of 3 places.

1. One pips outside the upper Keltner Channel

2. 1 pips above the 89 or 445 period moving average if they are directly above the Keltner Channels

3. 12-pips above the trade entry point. Never set your stop further than 12 pips away using this system and try to keep it tighter using the first two choices when possible. This will help you cut your losses short and stay in the game for a long time to come.

6. For this Keltner channels scalping system your profit goals should be modest with and emphasis on making several quick and small trades. I usually set my scalp trade exit orders immediately after I enter my protective stop in order to eliminate most of the emotional tendencies that naturally occur when trading. I set my exit price between 6 and 12-pips below my entry price.

Share your opinion, can help everyone to understand the forex strategy.